Comprehensive Rate Tables and Tools to Power Your Savings Goals

Welcome to MoneyGuide.ca! Do you want up-to-the-minute rate information without jumping through hoops? MoneyGuide.ca provides fast access to the best rates from 60 issuers in Canada. If you want the largest selection of product issuers and channels, click on one of the rate buttons below. RIF and GIC retirement options to accounts that help you reach your savings goals faster, you can access the top-performing products here. Are you looking for favourable mortgage terms? Find the terms that work for you by selecting the Mortgage Rates button.

Earn and save more with better rates – quickly, easily, and conveniently. For over four decades, MoneyGuide.ca experts have provided impartial data that puts you in control of your search for promising investment opportunities. We make it easy to compare rates from a variety of financial institutions. You don’t have to fill out forms and wait to get the information you want. Read More...

Rate Tables

We provide rate tables, comparison tools, and reports to give you easy to understand data on which to base your decisions.

- Guaranteed Investment Certificates (GICs) provide guaranteed returns for a fixed period. Compare minimum investments and interest rates for monthly to annual periods and cashable and compound interest opportunities.

- Registered Retirement Income Funds (RRIF) generate retirement income from investments available through various lenders. Compare minimum payments and returns on products that pay annually with terms of up to five years.

- Mortgage rate tables compare the best rates available through retail mortgage lenders. Choose from variable, open or closed, and convertible loans of varying periods.

- Tax-Free Savings Accounts (TFSAs) compare the updated rates from major financial institutions.

Many of the rate tables offer calculators, schedule generators, and reports that help you visualized potential investment results.

Calculators and Tools

Choose the calculators and tools you need to make the best decisions about your retirement and other financial goals, including the following options:

- Generate mortgage amortization schedules

- Retirement and savings calculators

- Retirement withdrawal schedules (How much will you get back from your savings efforts?)

- CRA guides to RRSP/RRIF

- Glossary of Financial Terms: Do you see financial terms that make your head spin? Although we keep the technical jargon to a minimum, we have provided a financial glossary of over 1,200 terms. You can access this handy tool alongside each rate table option.

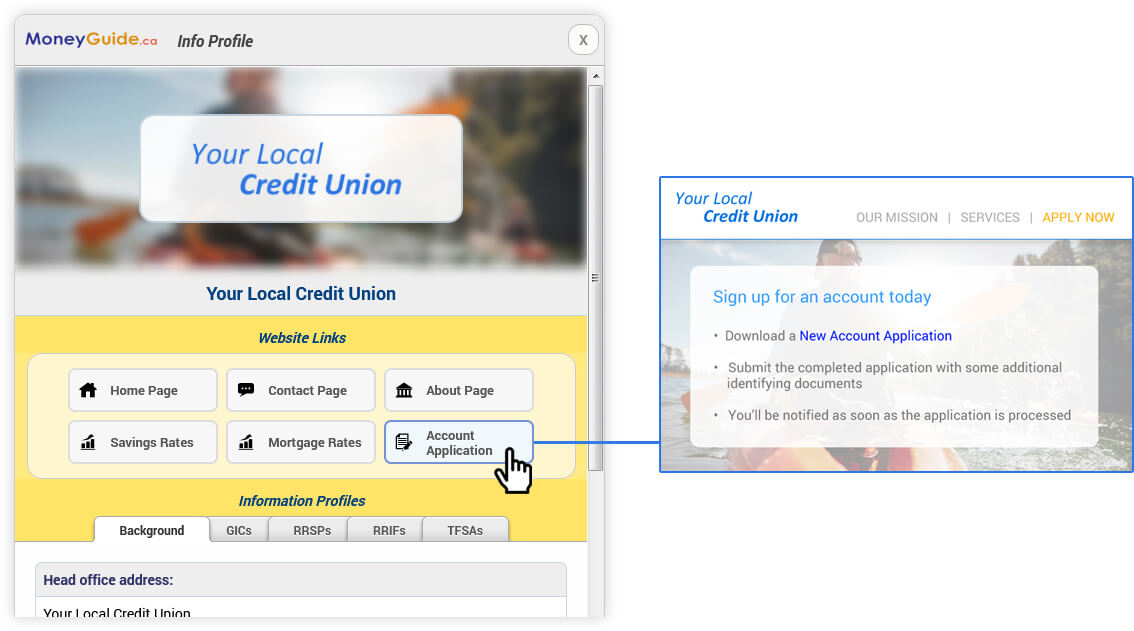

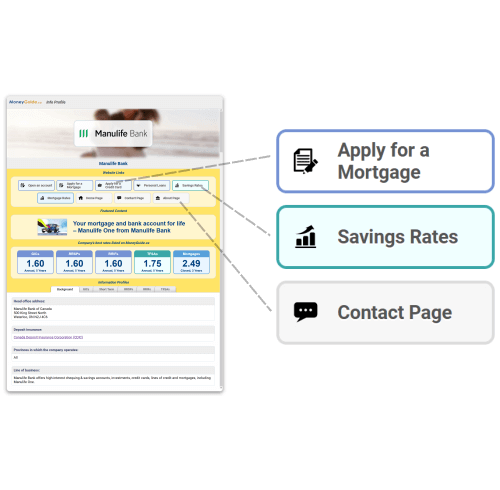

Click on the rate table that best meets your needs. This is a great way to strategize on the most favourable options for retirement preparation. We believe in providing all the information you need upfront. Further, if you decide to purchase one of the products in the rate tables, we make it easy to access the vendor without leaving our site. No matter what reason you’re looking to set money aside, our clickable tools make it easy to find the best rates so your investment can snowball.

Our Canadian Interest Rate Tables

We’ve provided the Canadian public with interest rate tables for decades. Here’s what’s on our menu:

GICs and Short-Term Deposit Rates

- GICs: 1-5 Year Deposit Rates

- Short-Term (under 1 Year) Deposit Rates

Retirement Savings Plan (RSP) Rates

- RSP Rates – Annual (1 to 5 Years)

Retirement Income Fund (RIF) Rates

- RIF Rates – Annual (1 to 5 Years)

- RIF Savings Accounts

Mortgage Rates

- Closed Mortgage Rates

- Open, Variable and Convertible Rates

- Long Term Rates (7-10 Years)

Savings Account Rates

- Tax-Free Savings Account

- Daily-Interest Savings Accounts

Consumer Surveys

- Bank Fees, Credit Card Fees, Car Loans and more

Money-Guiding: Interesting articles from around the web

We collect articles that we think might be worthwhile to our audience. Here are some that we think you’d find interesting:

Canada’s 2025 Pension Plan: Key Changes to CPP, OAS, and GIS Benefits

[From OAS – CPP Updates] As we step into a new era of retirement security, Canada’s 2025 Pension Plan emerges as a beacon of progress…

Why we prefer to go with the flow instead of changing course

[From Get SmarterAboutMoney.ca] Are you somebody who is comfortable with change? Or do you prefer things to stay the way they are? The field of…

I lost my wallet. Here’s what experts say I should do to protect my identity and money

[By Genna Contino, CNBC] I spend most days speaking with finance experts to inform the stories I write. After losing my wallet, I decided to…

CFA Institute targets questionable advice from finfluencers

[By Jonathan Got, Advisor.ca] Only 20% of finfluencer content containing investment recommendations has disclosures of any kind, a study by New York-based CFA Institute finds.

FSRA pegs ‘stranded’ pension plans at more than $3 billion

[By Sammmy Hudes, published on Investment Executive] FSRA, an independent regulator, says there are almost 200,000 pension plan members in the province who have lost…

5 ways Scammers are Targeting your Bank Account

[By Devin Partida, Financial Independence Hub] Scammers use various tactics to target victims’ financial data today, ranging from malware to fake giveaways. People can protect…

Canadian banks’ funding is stable despite losses since SVB failure

[By Advisor’s Edge] Canada’s banks have suffered losses since the collapse of Silicon Valley Bank (SVB) and the ensuing liquidity crisis, but the damage is…

The seven money myths that stand in the way of a good financial plan

[By Jennifer Cook, for Financial Independence Hub] As Canadians face year-end decisions on investments, taxes, and RRSPs, we at Co-operators have identified common gaps in…